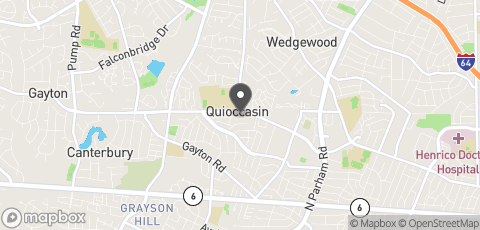

Henrico DMV Office: 9237 Quioccasin Road Richmond, VA 23229-5425

9237 Quioccasin Road Richmond, VA 23229-5425

Henrico, VA 23229

United States

Last updated on:

Henrico DMV Location & Hours

9237 Quioccasin Road Richmond, VA 23229-5425

Henrico, 23229

Henrico, 23229

Sun Closed

Mon 8:00 am - 5:00 pm

Tue 8:00 am - 5:00 pm

Wed 8:00 am - 5:00 pm

Thu 8:00 am - 5:00 pm

Fri 8:00 am - 5:00 pm

Sat 8:00 am - 12:00 pm

Henrico DMV Office Services

- Offers all DMV Services

Henrico DMV Office Notes

The West Henrico Customer Service Center has temporary discontinued Motorcycle road test until further notice.

Don't Forget to Leave a Review!

Let us know how this location handled your transaction. Did you have any issues?

Photos of Office

No Photos Available

Henrico Virginia DMV Reviews and Tips

Lousy. Cannot get a person by phone and the appointments list does not include the Quioccasin ( Henrico) office.

11:34 am, Feb 17

Went in without an appointment to renew driver's license and was in and out in 25 minutes. Best DMV experience I've ever even heard of. All staff were friendly and helpful. Was weekday afternoon.

9:56 am, Feb 27

We had a terrible experience with this DMV. The guy that was assigned to us was so rude AND not willing to help answer our questions. It was shocking!! We ended up going to the DMV in Eastern Henrico and had a much better experience. I do not recommend going to the DMV on Quioccasin Road.

4:48 pm, Mar 14

While I realize my situation applies to very few people, perhaps the system will be changed to properly accommodate the few, possibly more in the future, people who find themselves in this situation.

First, my general impression of this DMV facility; I've had fairly good experiences at this location in the past. I went on a Monday and found the lines (appointment and non-appointment – I did not have an appointment) moved well and there was only a short wait for the number I was given. The three people I interacted with (one at the initial line, one at the window, and the supervisor) seemed only modestly helpful and devoid of any personality.

I had purchased a kayak trailer online and was at DMV to register it. The online seller had collected sales tax and emailed me a proof of purchase, stating both the purchase price and the tax charged. When I was charged, in addition to the titling fee and license plate, sales tax again by DMV, I indicated I had already paid tax. First, the guy working with me said I should go to the seller and get them to issue me a refund check. I didn't think this was realistic and again stated that DMV should not charge me tax since I had already paid it. He then asked for a proof of purchase identifying the tax paid. I showed him the proof of purchase email the seller had sent me. He then said he could not accept anything on my phone. I was quite upset at paying the tax again and the gentleman working with me brought out a supervisor who was not very helpful. I had already paid the total charges for the registration, including the sales and use tax and was given a form for application for a refund of sales and use tax that states that I erroneously paid the tax and requires me to complete and attach an additional form that I was not given at DMV and includes reasons why I am exempt from sales tax and use the proper exemption code, none of which match my situation (and I don’t claim to be exempt from paying the tax, once). I got the distinct feeling that the DMV employees were going to keep changing the requirements until I gave in.

This seems to be a case of the applicable laws have not kept pace with technology. Both DMV and the on-line seller are required, as I understand it, to collect Virginia sales tax, yet the tax should only be paid once. And, DMV did not offer a realistic option. It’s sad when it’s easier to pay to tax twice than to try to rectify it.

The manufacturer, not the seller, had included information for use when registering the trailer. I assume the same logic that was used to determine whether to include the registration information could be used to exempt the seller from collecting the sales tax on the item. Then, the buyer would, legally, either have to register the trailer (paying the tax) or declare that the tax had not been paid on his or her income tax form rather than be required to pay the tax twice (which is not correct). I believe there are other solutions as well, but anything that allows the person registering such a “vehicle” to pay the sales tax only once would be better than the current method of paying the sales tax twice.

First, my general impression of this DMV facility; I've had fairly good experiences at this location in the past. I went on a Monday and found the lines (appointment and non-appointment – I did not have an appointment) moved well and there was only a short wait for the number I was given. The three people I interacted with (one at the initial line, one at the window, and the supervisor) seemed only modestly helpful and devoid of any personality.

I had purchased a kayak trailer online and was at DMV to register it. The online seller had collected sales tax and emailed me a proof of purchase, stating both the purchase price and the tax charged. When I was charged, in addition to the titling fee and license plate, sales tax again by DMV, I indicated I had already paid tax. First, the guy working with me said I should go to the seller and get them to issue me a refund check. I didn't think this was realistic and again stated that DMV should not charge me tax since I had already paid it. He then asked for a proof of purchase identifying the tax paid. I showed him the proof of purchase email the seller had sent me. He then said he could not accept anything on my phone. I was quite upset at paying the tax again and the gentleman working with me brought out a supervisor who was not very helpful. I had already paid the total charges for the registration, including the sales and use tax and was given a form for application for a refund of sales and use tax that states that I erroneously paid the tax and requires me to complete and attach an additional form that I was not given at DMV and includes reasons why I am exempt from sales tax and use the proper exemption code, none of which match my situation (and I don’t claim to be exempt from paying the tax, once). I got the distinct feeling that the DMV employees were going to keep changing the requirements until I gave in.

This seems to be a case of the applicable laws have not kept pace with technology. Both DMV and the on-line seller are required, as I understand it, to collect Virginia sales tax, yet the tax should only be paid once. And, DMV did not offer a realistic option. It’s sad when it’s easier to pay to tax twice than to try to rectify it.

The manufacturer, not the seller, had included information for use when registering the trailer. I assume the same logic that was used to determine whether to include the registration information could be used to exempt the seller from collecting the sales tax on the item. Then, the buyer would, legally, either have to register the trailer (paying the tax) or declare that the tax had not been paid on his or her income tax form rather than be required to pay the tax twice (which is not correct). I believe there are other solutions as well, but anything that allows the person registering such a “vehicle” to pay the sales tax only once would be better than the current method of paying the sales tax twice.

8:51 am, Oct 13

Write a Review/Tip

Questions and Answers

There are no questions yet, be the first!